Best Forex Trading Software Your Comprehensive Guide

When it comes to forex trading, choosing the right software is crucial for your success in the market. The forex market is one of the most dynamic and fast-paced trading environments, which is why having the best forex trading software can make a significant difference. In this article, we will explore the top forex trading software options available, their features, benefits, and why they are favored by many traders worldwide. Additionally, we’ll introduce you to best forex trading software Qatari Trading Platforms that can offer unique opportunities for traders in the Middle East.

Understanding Forex Trading Software

Forex trading software refers to tools that allow traders to analyze the forex market, execute trades, and manage their investment portfolios. The right software can help traders make informed decisions, monitor real-time market conditions, and automate their trading strategies. There are several types of forex trading software, including trading platforms, charting tools, and analysis software.

Types of Forex Trading Software

- Trading Platforms: These are the core software that traders use to execute trades. They provide access to the forex market, enable order placement, and offer various analytical tools.

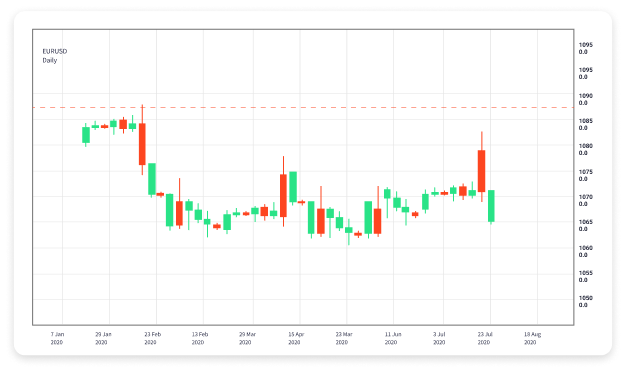

- Charting Software: Charting tools are essential for technical traders. They allow for advanced analysis of price movements, trends, and patterns using various indicators.

- Automated Trading Systems: Also known as Expert Advisors (EAs), these are programs that can execute trades automatically based on predefined criteria.

- Mobile Trading Apps: With the increasing use of smartphones, mobile trading apps have become essential for traders who need access to their accounts on the go.

Top Forex Trading Software Options

1. MetaTrader 4 (MT4)

MetaTrader 4 is arguably the most popular forex trading platform worldwide. It is favored by both beginner and professional traders due to its user-friendly interface and extensive functionality. MT4 offers advanced charting tools, a wide range of technical indicators, and supports automated trading through EAs. Its security features and the ability to customize trading algorithms make it a top choice.

2. MetaTrader 5 (MT5)

Building on the strengths of MT4, MetaTrader 5 provides additional features such as more timeframes, more order types, and an economic calendar directly integrated into the platform. It is suitable for trading a variety of asset classes beyond forex, such as stocks and commodities. The multi-currency strategy tester is another significant improvement, enhancing the testing and optimization of trading strategies.

3. cTrader

cTrader is known for its intuitive interface and advanced charting capabilities. It offers features that cater specifically to algorithmic traders, including cAlgo for automated trading strategies. Furthermore, cTrader has a cloud-based solution, allowing users to access their accounts from any device without the need for downloads.

4. NinjaTrader

NinjaTrader is primarily recognized as a futures trading platform, but it has a strong forex trading suite as well. This platform excels in providing exceptional market analysis tools, advanced charting options, and customizable features for traders who want a tailored experience. The free version allows users to use trade simulation and backtesting features, making it appealing for new traders.

5. TradingView

For traders who prioritize social trading and community engagement, TradingView is the go-to platform. It allows users to create, share, and discuss trading ideas through a vibrant community. TradingView offers powerful charting capabilities and integrates numerous technical indicators, making it useful for both Forex and cryptocurrency trading.

6. Thinkorswim

Offered by TD Ameritrade, Thinkorswim is a robust trading platform that provides a plethora of trading tools, educational resources, and sophisticated analytics. This software is well-suited for both beginners and advanced traders who appreciate an all-in-one solution that includes educational content.

Key Features to Consider

When choosing the best forex trading software, consider the following features:

- User Interface: A clean, intuitive interface can make trading much easier, especially for beginners.

- Charting Tools: Comprehensive charting tools with a variety of technical indicators are essential for analysis.

- Automated Trading: The ability to automate trades can be a significant advantage, so consider platforms that support EAs or algo trading.

- Mobile Compatibility: Ensure that the software has a mobile version or app so you can trade on the go.

- Customer Support: Efficient customer support can resolve issues that arise during trading.

- Security: Opt for software that offers robust security features to protect your data and funds.

Final Thoughts

Selecting the best forex trading software is a critical step toward achieving trading success. The right platform can streamline your trading process, enhance your analysis, and provide you with necessary market insights. While tools like MetaTrader and cTrader are popular, make sure to assess your own trading style and requirements before making a choice. Remember, effective forex trading isn’t just about having the right software, but also about continuous education and strategy improvement.

Whether you are a novice trader just starting or an experienced investor looking to optimize your trading strategy, investing time into finding the best forex trading software suitable for your needs can significantly impact your trading experiences and outcomes. Happy trading!