How to Open a Forex Trading Account A Complete Guide 1908134266

Opening a Forex trading account is the first step towards entering the exciting world of currency trading. For beginners and experienced traders alike, understanding how to choose the right account can significantly influence your trading success. This guide will walk you through the whole process, including what to look for in a trading platform, the different types of accounts available, and key considerations before you sign up. Additionally, consider checking out forex trading account opening Thai Trading Platforms for more options.

Understanding Forex Trading Accounts

A Forex trading account is a platform that allows you to buy and sell currency pairs. In essence, it acts as a bridge between you and the Forex market. To open an account, you typically need to choose a brokerage that aligns with your trading goals and meets your requirements. Factors such as fees, trading tools, availability of currency pairs, and customer service are essential when selecting a broker.

Types of Forex Trading Accounts

Forex brokers offer various types of accounts to cater to different trading styles and experience levels. Here’s a closer look at some common types:

- Demo Accounts: These accounts allow you to practice trading without risking real money. They simulate the live market environment and are an excellent way for beginners to learn the ropes.

- Standard Accounts: Ideal for experienced traders, these accounts typically require a higher minimum deposit and offer access to advanced trading tools and analytics.

- Mini and Micro Accounts: These accounts are designed for those who want to trade smaller positions. They require lower minimum deposits and allow traders to manage risk effectively.

- Islamic Accounts: These accounts comply with Sharia law, meaning they do not incur interest charges (swap-free trading), making them suitable for Muslim traders.

Steps to Open a Forex Trading Account

Opening a Forex trading account is a straightforward process. Here’s a step-by-step guide:

- Choose a Broker: Start by researching different Forex brokers. Look for reviews and test their platforms via demo accounts.

- Gather Required Documents: Most brokers require identification documents to verify your identity. Typically, you’ll need a government-issued ID and proof of address.

- Fill Out the Application: Complete the online registration form. Be prepared to provide personal information such as your name, address, and financial background.

- Account Verification: Once your application is submitted, the broker will verify your information. This process may take a few hours to a couple of days.

- Deposit Funds: After verification, you can fund your trading account. Brokers often provide multiple payment methods, including bank transfers, credit cards, and e-wallets.

- Start Trading: With your account set up and funded, you can start trading. Familiarize yourself with the broker’s trading platform and tools available.

Key Considerations Before Opening an Account

Before you dive into trading, consider the following aspects to ensure a smooth experience:

- Regulation: Choose a broker regulated by a reputable authority. This helps ensure that your funds are safe and that the broker follows fair trading practices.

- Spreads and Fees: Understand the broker’s fee structure, including spreads and commissions. Lower fees can enhance your profitability.

- Leverage Options: Leverage can amplify your gains but also your losses. Ensure you understand how leverage works and choose an amount that aligns with your risk tolerance.

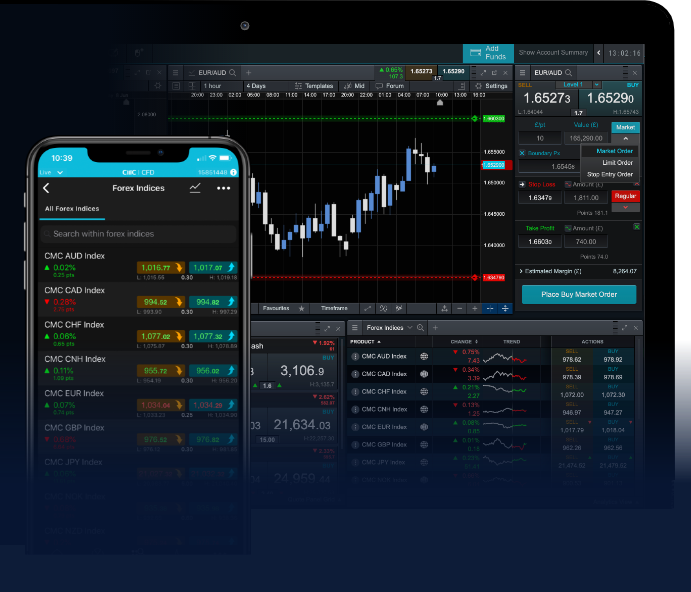

- Trading Tools: Look for brokers that offer comprehensive trading tools, such as market analysis, advanced charting, and risk management features.

Tips for New Forex Traders

If you’re new to Forex trading, keep these tips in mind to improve your chances of success:

- Start with a Demo Account: Before committing real money, practice trading on a demo account to build your skills and confidence without financial risk.

- Learn About Trading Strategies: Familiarize yourself with various trading strategies, including day trading, swing trading, and scalping, to find what suits you best.

- Develop a Trading Plan: Outline your trading goals, risk management strategies, and preferred trading frameworks to stay disciplined and organized.

- Stay Informed: Keep up with market news and economic indicators that affect currency prices. Information is key to making informed trading decisions.

Conclusion

Opening a Forex trading account is an exciting first step towards becoming a successful trader. By understanding the types of accounts available, the steps to open one, and important considerations, you will be better prepared to navigate the Forex market. As a newbie or an experienced trader, continuously educating yourself about trading practices and market dynamics is vital to enhancing your trading journey. With dedication and the right approach, you can effectively build your trading career.