Mastering Forex Trading Practical Insights for Success

Mastering Forex Trading: Practical Insights for Success

Forex trading, or foreign exchange trading, is a vast and dynamic market where currencies are bought and sold. As one of the largest and most liquid financial markets in the world, mastering forex trading calls for a thorough understanding of the practice itself. Many traders come into the forex world with aspirations of quick profits, but without proper education and practice, success can be elusive. In this article, we will explore various aspects of forex trading practice, including strategies, risk management, the importance of psychological preparedness, and resources to help you on your journey to trading mastery. For those interested in reliable partnerships, consider checking out forex trading practice Qatar Brokers for guidance.

Understanding Forex Trading

At its core, forex trading involves the exchange of one currency for another. Currencies are traded in pairs, and the price movement of a pair is determined by the exchange rate between the two currencies. The forex market operates 24 hours a day during weekdays, providing traders with unlimited opportunities to engage in trading. Understanding market fundamentals, including economic indicators, geopolitical events, and market sentiment, is critical for effective trading.

The Importance of Practice

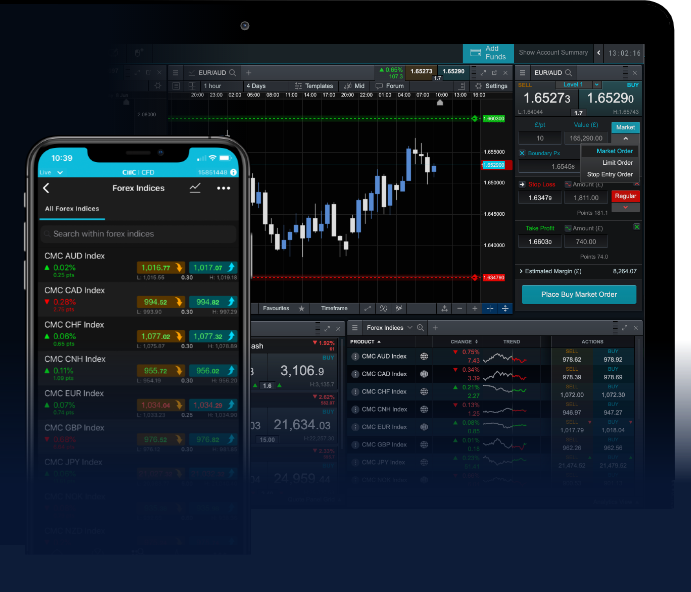

Just like any other skill, forex trading requires practice. It’s not sufficient to merely read about strategies or rely on tips from seasoned traders. Engaging in practice trading with a demo account can help you gain invaluable experience without risking real money. Many reputable brokers offer demo accounts where you can use virtual funds to simulate a trading environment. This allows you to refine your skills, test different strategies, and develop a trading plan tailored to your style.

Setting Up a Demo Account

To get started with practice trading, you first need to set up a demo account. Choose a reputable forex broker that offers a user-friendly platform and a demo account option. After creating an account, you will be able to access trading tools, charts, and market data, all while using virtual funds. Here are some tips for effectively using a demo account:

- Replicate Real Conditions: Treat your demo account like a real trading account. Set specific goals, risk management parameters, and trading strategies.

- Track Performance: Keep a trading journal to document your trades, emotions, successes, and mistakes. This will help you identify patterns in your trading behavior.

- Experiment with Different Strategies: Use the demo account to test various trading strategies, from swing trading to scalping, to see what resonates with your trading style.

Developing a Trading Strategy

A robust trading strategy is crucial for consistency in forex trading. A trading strategy provides a set of rules that dictate when to enter and exit trades, helping you avoid emotionally driven decisions. Here are some components of a successful trading strategy:

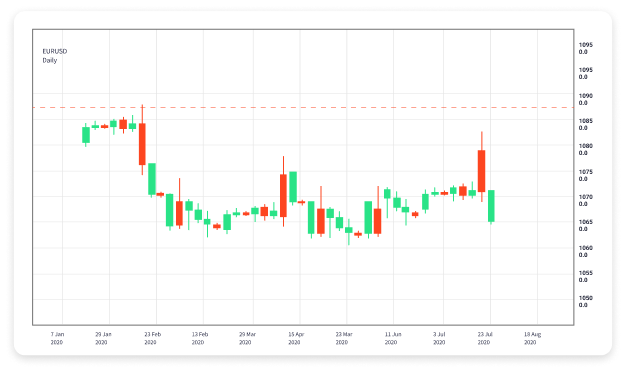

- Technical Analysis: Utilize technical indicators, chart patterns, and trend analysis to help inform your trading decisions.

- Fundamental Analysis: Keep an eye on economic news, interest rates, and geopolitical events that may affect currency values.

- Risk Management: Determine your risk tolerance and use stop-loss and take-profit orders to manage your trades effectively.

Risk Management Strategies

Risk management is an essential element of forex trading that should not be overlooked. Proper risk management helps protect your capital and can lead to long-term success. Here are some common risk management strategies:

- Position Sizing: Calculate the appropriate size of your trades based on your account balance and risk tolerance. A common rule is to risk no more than 1-2% of your capital on a single trade.

- Use of Stop-Loss Orders: Implement stop-loss orders to limit potential losses on each trade. This ensures you exit a position if the market moves against you.

- Diversification: Avoid putting all your eggs in one basket. Diversifying your trades across different currency pairs can help spread risk.

Psychological Preparedness

The psychological aspect of trading is often underestimated, yet it can greatly impact your performance. Emotions such as fear and greed can lead to poor decision-making. Therefore, it’s essential to cultivate a disciplined mindset. Here are some tips to enhance your psychological preparedness:

- Maintain Emotional Control: Recognize your emotions and learn to manage them. Avoid making impulsive decisions based on short-term market movements.

- Set Realistic Expectations: Understand that losses are part of trading. Set realistic profit targets and don’t expect to win on every trade.

- Stay Informed but Not Overwhelmed: Keep yourself updated with market news, but avoid information overload that may cause confusion and anxiety.

Continual Learning and Improvement

The forex market is constantly evolving, making it imperative for traders to commit to ongoing learning. Participate in webinars, read trading books, and join trading communities to exchange ideas and experiences. This not only enhances your knowledge but also builds connections with other traders.

Conclusion

Forex trading practice is an essential part of becoming a successful trader. By setting up a demo account, developing trading strategies, implementing effective risk management, preparing psychologically, and committing to continual learning, you can enhance your trading skills and confidence. Remember, success in forex trading doesn’t come overnight; it requires dedication, persistence, and a commitment to improving your craft. Dive into the world of forex trading with a solid plan, and you will increase your chances of achieving your financial goals.